Filing Requirements of Withholding Tax Forms

W2/1099 for the State of Georgia

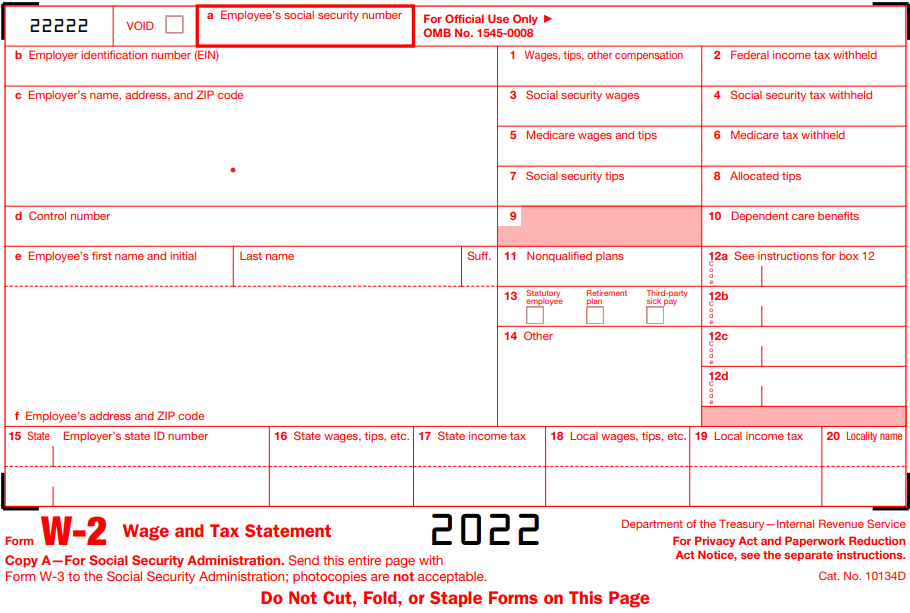

Form W-2

The State of Georgia mandates the filing of annual withholding Transmittal Form G-1003 along with Form W2. Generally, Form W2 provides an annual statement of gross wages, social security wages, and tax withholdings.

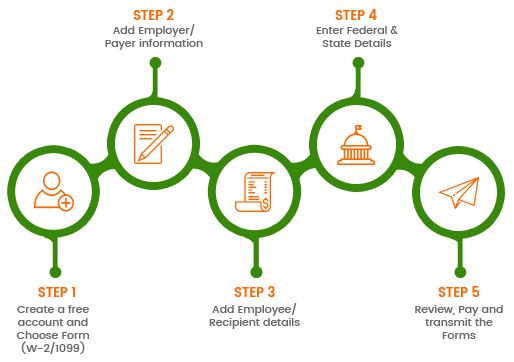

You can file G-1003 along with W2 for the state of Georgia electronically with our e-filing application.

Form G-1003: G-1003 Withholding Income Statement Transmittal

Form G-1003 is filed by businesses in Georgia to report the State taxable wages & tax withheld during the tax year.

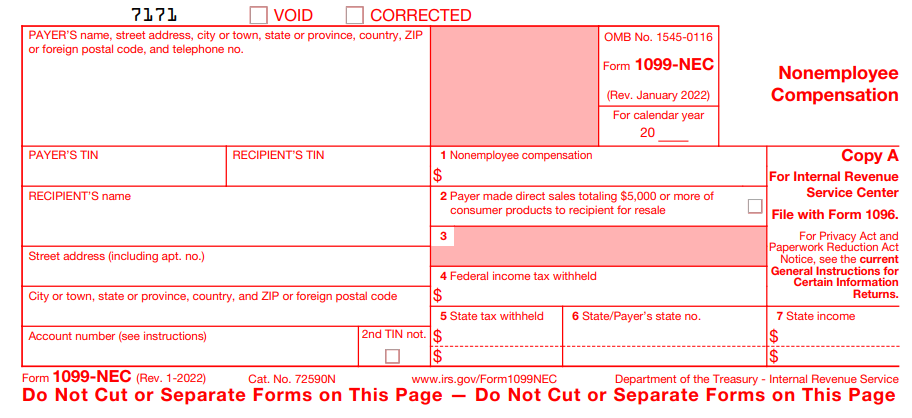

Form 1099

Georgia requires that you file 1099 forms directly with the state. The filing of Withholding Income Statement Transmittal G-1003, along with 1099 forms is required. You must file the required 1099 forms ONLY if there is state Withholding.

Generally, Form 1099 is used to report the payments made to contractors, interest income, dividend, rental property income, etc.,

Following 1099 Forms needs to be filed with the State of Georgia: